Tickmill Broker Review: A Comprehensive Analysis of Trading Services and Features

Tickmill Broker: Everything You Need to Know Before Opening an Account. Learn about the trading conditions, fees, and customer support in our in-depth review.

When it comes to forex trading, choosing the right broker can make a big difference in your success. Tickmill is a popular choice among traders, offering a range of trading services and features. However, before you open an account with Tickmill, it's important to understand the trading conditions, fees, and customer support you can expect. In this in-depth review, we'll take a comprehensive look at Tickmill Broker and evaluate its performance and user experience. Whether you're a seasoned trader or just getting started, read on to learn everything you need to know about Tickmill before making a decision.

Content Table

| TICKMILL |

|---|

| Regulations |

| Trading Platform |

| Account types |

| Available trading pairs |

| Deposit and withdrawal methods |

| Restrictions |

| Customer Support |

Regulations of Tickmill

One of the most important aspects to consider when choosing a forex broker is the regulatory oversight they operate under. This is important because regulation provides a framework that ensures brokers operate in a transparent and fair manner. It also provides protection for traders in case of any malpractice or financial mishandling by the broker.

Tickmill is a global forex and CFD broker that operates under the regulatory oversight of several reputable authorities. These include the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Seychelles Financial Services Authority (FSA) in Seychelles.

The FCA is one of the most respected financial regulatory bodies in the world and is known for its stringent regulations. As a regulated entity of the FCA, Tickmill must adhere to strict rules and regulations, including the segregation of client funds, regular financial reporting, and anti-money laundering (AML) procedures. This ensures that client funds are protected and that the broker operates in a transparent and ethical manner.

The CySEC is the financial regulatory agency of Cyprus and is responsible for regulating the financial industry in the country. As a regulated entity of the CySEC, Tickmill must adhere to strict regulations and undergo regular audits to ensure that it operates in accordance with the law.

The FSA is the regulatory body responsible for overseeing the financial industry in Seychelles. As a regulated entity of the FSA, Tickmill must adhere to strict rules and regulations that ensure it operates in a transparent and ethical manner.

In addition to adhering to the regulations set forth by these authorities, Tickmill also employs robust internal policies and procedures to ensure that it meets the highest standards of compliance. This includes regular internal audits and risk management procedures to ensure that the company is operating within the regulatory framework set by the various authorities.

regulatory oversight is an important factor to consider when choosing a broker because it provides assurance that the broker operates in a fair and transparent manner. It also provides protection for clients in case of any financial mishandling by the broker. As a regulated broker, Tickmill is held accountable to strict regulations, providing clients with confidence in the safety and security of their funds.

Trading Platform

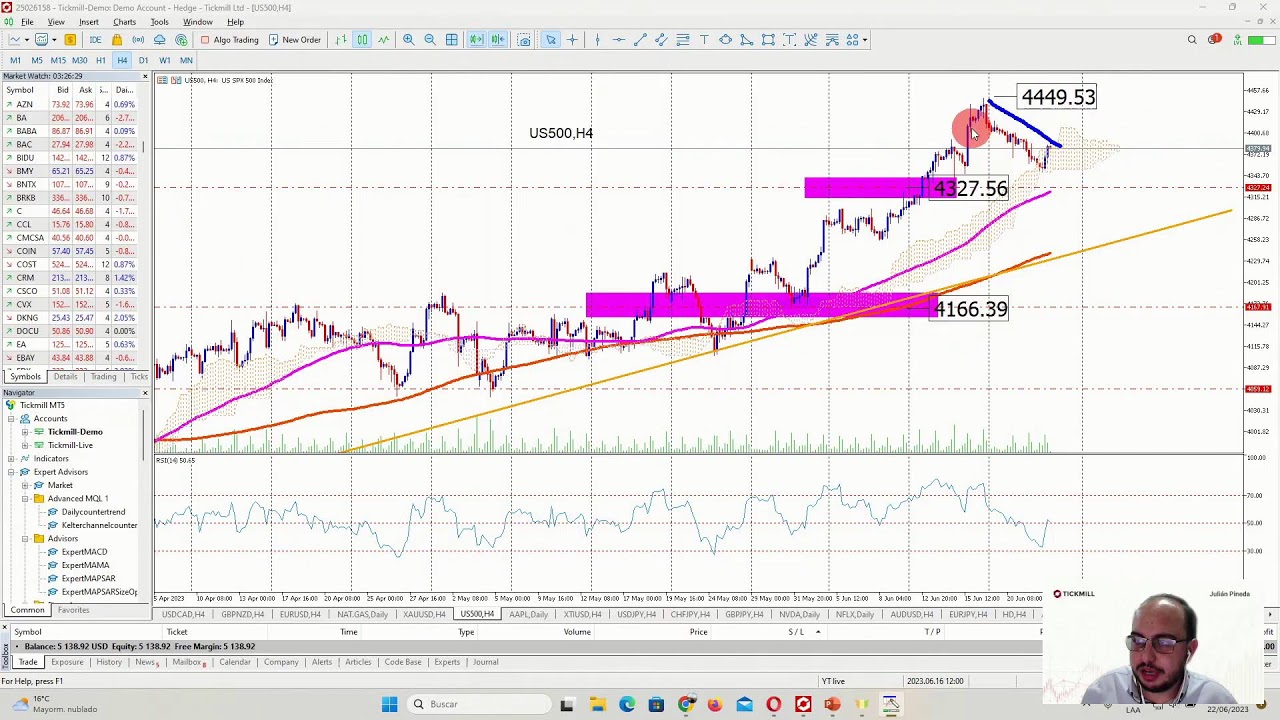

Tickmill offers its clients a range of trading platforms to choose from, including the popular MetaTrader 4 (MT4) platform and its successor, MetaTrader 5 (MT5). These platforms are widely used in the forex and CFD industry and offer a range of advanced features and tools that cater to the needs of both beginner and experienced traders.

MetaTrader 4 is a popular platform that has been in the market for over a decade. It is well known for its user-friendly interface, extensive charting capabilities, and the ability to customize indicators and trading robots. MT4 is compatible with Windows, macOS, iOS, and Android operating systems, making it accessible to traders on various devices.

MetaTrader 5, on the other hand, is a newer platform that offers a range of advanced features that are not available on MT4. These include the ability to trade stocks and futures, a built-in economic calendar, and a depth of market (DOM) feature. MT5 is also compatible with a wider range of assets, including forex, stocks, indices, and commodities.

In addition to MT4 and MT5, Tickmill also offers a web-based platform, Tickmill Web Trader, which is accessible through a web browser on any device with an internet connection. The Web Trader platform provides traders with access to real-time market data, charting tools, and the ability to execute trades from any location.

Tickmill also offers mobile trading platforms for both MT4 and MT5, which can be downloaded from the App Store or Google Play. The mobile apps offer traders the ability to access their accounts, view real-time market data, and execute trades from their mobile devices.

Overall, Tickmill provides its clients with a range of trading platforms to choose from, including the popular MetaTrader 4 and 5 platforms, a web-based platform, and mobile trading apps. These platforms are user-friendly and offer a range of advanced features and tools to cater to the needs of traders of all levels.

Account types:

Tickmill offers its clients a range of account types to choose from, each tailored to meet the needs of different types of traders. Here is an overview of the account types available:

1. Classic Account: This account type is designed for beginner traders and offers tight spreads starting from 1.6 pips. The minimum deposit for this account is $100, and it comes with a leverage of up to 1:500.

2. Pro Account: The Pro Account is designed for more experienced traders who require lower spreads and higher leverage. Spreads for this account start from 0.0 pips, and the minimum deposit is $100. The Pro Account comes with a leverage of up to 1:500.

3. VIP Account: The VIP Account is designed for professional traders who require the lowest spreads and highest leverage. Spreads for this account start from 0.0 pips, and the minimum deposit is $50,000. The VIP Account comes with a leverage of up to 1:500.

4. Islamic Account: Tickmill offers Islamic accounts for traders who follow the principles of Sharia law. These accounts do not charge any swap fees or rollover interest, and they operate on a commission-based fee structure.

5. Demo Account: Tickmill also offers a demo account that allows traders to practice their trading strategies without risking any real money. The demo account comes with virtual funds, and traders can use it to test the different trading platforms and practice their skills. demo account has the following general features:

- Access to the trading platform: demo account allows you to access the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) trading platform, which are popular and reliable platforms used by many traders worldwide.

- Virtual capital: demo account provides you with a virtual balance of up to 100,000 units of your chosen base currency so you can practice your trading strategies without risking your own capital.

- Financial instruments: demo account offers access to a wide range of financial instruments, including over 80 currency pairs, as well as CFDs on indices, commodities, and stocks.

- Spread and commissions: demo account uses spreads and commissions similar to those of a real account, allowing you to familiarize yourself with the trading costs and evaluate their impact on your profitability.

- Usage time: demo account has unlimited duration, which means you can practice and refine your trading skills for as long as you want.

- Technical support: demo account offers 24/7 technical support via live chat, email, and phone. Click here to open a practice account with Tickmill and start exploring all that this broker has to offer!

It is important to note that each account type comes with its own set of features and benefits, and traders can choose the account that best suits their needs and trading preferences. All of account types offer fast order execution, access to advanced trading tools, and a wide range of financial instruments available for trading. Additionally, traders can open free demo accounts to test the platform and familiarize themselves with the features and tools of each account type before trading with real money.

All of the account types offered by Tickmill come with access to a range of trading instruments, including forex, stocks, indices, commodities, and bonds. The broker also offers a range of educational resources and trading tools to help traders improve their skills and achieve their trading goals.

Available trading pairs:

Tickmill offers a wide range of currency pairs for trading, including major, minor, and exotic pairs. Traders can choose from more than 80 currency pairs, allowing them to diversify their portfolio and take advantage of various trading opportunities.

The major currency pairs available on Tickmill include popular pairs such as EUR/USD, GBP/USD, USD/JPY, and USD/CHF. These pairs are known for their high liquidity and tight spreads, making them popular among traders.

Minor currency pairs, also known as cross currency pairs, include currency pairs that do not include the US dollar as one of the currencies in the pair. Examples of minor currency pairs available on Tickmill include EUR/GBP, AUD/NZD, and CAD/JPY.

Exotic currency pairs, on the other hand, are currency pairs that include one major currency and one currency from a developing or emerging economy. Examples of exotic currency pairs available on Tickmill include USD/ZAR, USD/TRY, and USD/MXN. These pairs are known for their higher spreads and lower liquidity, making them riskier to trade but potentially more profitable.

Overall, Tickmill offers a wide range of currency pairs for traders to choose from, allowing them to tailor their trading strategies to their specific preferences and risk appetite.

Deposits and withdrwal methods:

Tickmill offers a variety of deposit and withdrawal methods to make it easy for traders to fund their accounts and withdraw their profits. The available methods vary depending on the client's country of residence, but generally include the following:

1. Bank Wire Transfer: This is a popular method for depositing and withdrawing funds. It allows for large transactions and is usually free, but may take several business days to process.

2. Credit and Debit Cards: Tickmill accepts major credit and debit cards, including Visa and Mastercard. Deposits are usually processed instantly, while withdrawals may take a few business days to process.

3. E-wallets: Tickmill supports a variety of e-wallets, including Neteller, Skrill, and FasaPay. These methods are known for their fast processing times and low fees.

4. Local Payment Methods: Tickmill also supports local payment methods in certain regions, such as Sofort and iDeal in Europe and Online Banking in Asia.

It's important to note that some deposit and withdrawal methods may have fees associated with them, so traders should check the Tickmill website for the latest information.

Tickmill also has a strict policy of only allowing withdrawals to be made to the same source as the deposit. This means that if a trader deposits funds using a certain payment method, they must withdraw their profits using the same method.

Overall, Tickmill offers a range of convenient deposit and withdrawal methods to make it easy for traders to manage their accounts.

Restrictions:

Like any other financial institution, Tickmill has certain restrictions in place to ensure compliance with legal and regulatory requirements and to protect the interests of its clients and the company. Here are some of the key restrictions to keep in mind:

1. Country Restrictions: Tickmill has specific country restrictions for clients who are not allowed to open an account due to regulatory or compliance reasons. It's important to check with customer support team to confirm whether or not you are eligible to open an account.

2. Minimum Deposit Requirement: Tickmill has a minimum deposit requirement for each type of account. The exact amount varies depending on the account type and the client's country of residence. It's important to check the Tickmill website for the latest information on minimum deposit requirements.

3. Margin Requirements: Tickmill has specific margin requirements for each instrument offered. This means that traders must have sufficient funds in their account to cover any margin calls that may arise.

4. Maximum Leverage: Tickmill has a maximum leverage limit for each instrument offered. This means that traders cannot exceed the specified leverage limit for a given instrument.

5. Bonus Restrictions: Tickmill offers bonuses and promotions to its clients from time to time. However, there are restrictions on the amount and frequency of bonuses that can be received. Traders must also meet certain trading volume requirements before being able to withdraw bonus funds.

6. Trading Restrictions: Tickmill may impose certain trading restrictions on clients to protect against market abuse or manipulation. This may include restrictions on certain trading strategies or instruments.

Overall, it's important to be aware of these restrictions when trading with Tickmill to ensure compliance and avoid any potential issues. Traders should also read and understand the terms and conditions of their account type and any promotions they participate in.

Customer support:

Tickmill offers customer support services to its clients via multiple channels, including live chat, email, phone, and a dedicated client area. The customer support team is available 24/5 and can assist clients with various inquiries related to their trading account, trading platforms, deposits, withdrawals, and more.

Customer service is an important aspect in any financial services company, including forex brokers like Tickmill. In terms of customer service, Tickmill offers several options for its clients:

1. Support in multiple languages: Tickmill offers support in several languages, including English, Spanish, Italian, French, German, and others. This is an advantage for clients who prefer to communicate in their native language.

2. 24-hour customer service: Tickmill offers customer support 24 hours a day, 5 days a week, which means clients can receive help at any time during market hours.

3. Multiple support channels: Clients can contact Tickmill through various channels, including email, live chat, and phone. Additionally, the Tickmill website has a FAQ section to address common client inquiries.

Regarding the quality of customer service, customer feedback and reviews are mostly positive. Clients have reported that support representatives are quick and effective in resolving issues and responding to inquiries. However, as with any service company, there may be occasions where clients are not satisfied with the quality of customer service. In these cases, Tickmill offers a complaints and grievances process to address any issues that may arise.

Conclusion:

In conclusion, Tickmill is a reputable and reliable forex broker with a wide range of trading instruments, advanced trading platforms, and competitive trading conditions. The broker is regulated by top-tier financial authorities and provides a safe and secure trading environment for its clients. Tickmill offers various account types to cater to different trading styles and preferences, and its demo account provides a risk-free environment for traders to practice and improve their skills. The broker also provides excellent customer support in multiple languages and through various channels, ensuring that clients receive timely assistance whenever they need it. Overall, Tickmill is a great choice for both novice and experienced traders looking for a trustworthy and professional forex broker.

We hope that this comprehensive analysis has been helpful in making an informed decision about whether Tickmill is the right choice for you.

We would love to hear your thoughts on Tickmill, so please leave a comment in the section below. If you found this article helpful, we invite you to share it with your friends, family, or acquaintances interested in trading. You can also share it on your social media to help us reach more people interested in the topic. Thank you for reading!

¿Cuál es tu reacción?

Me gusta

0

Me gusta

0

No me gusta

0

No me gusta

0

Me encanta

0

Me encanta

0

Me divierte

0

Me divierte

0

Me enoja

0

Me enoja

0

Me entristece

0

Me entristece

0

Me asombra

0

Me asombra

0

![Milady Memecoin [LADYS] se dispara más de un 5250% tras el tweet de Elon Musk](https://blog.easycryptos.org/uploads/images/202404/image_430x256_662cfc1886c27.webp)