Bitcoin Volatility Soars as Federal Reserve Chair's Comments Shake Markets

Discover how Bitcoin experienced increased volatility near the $27,000 mark following remarks made by Federal Reserve Chair Jerome Powell. Explore the impact of Powell's comments on BTC price action, market sentiment, and the potential implications for interest rate hikes.

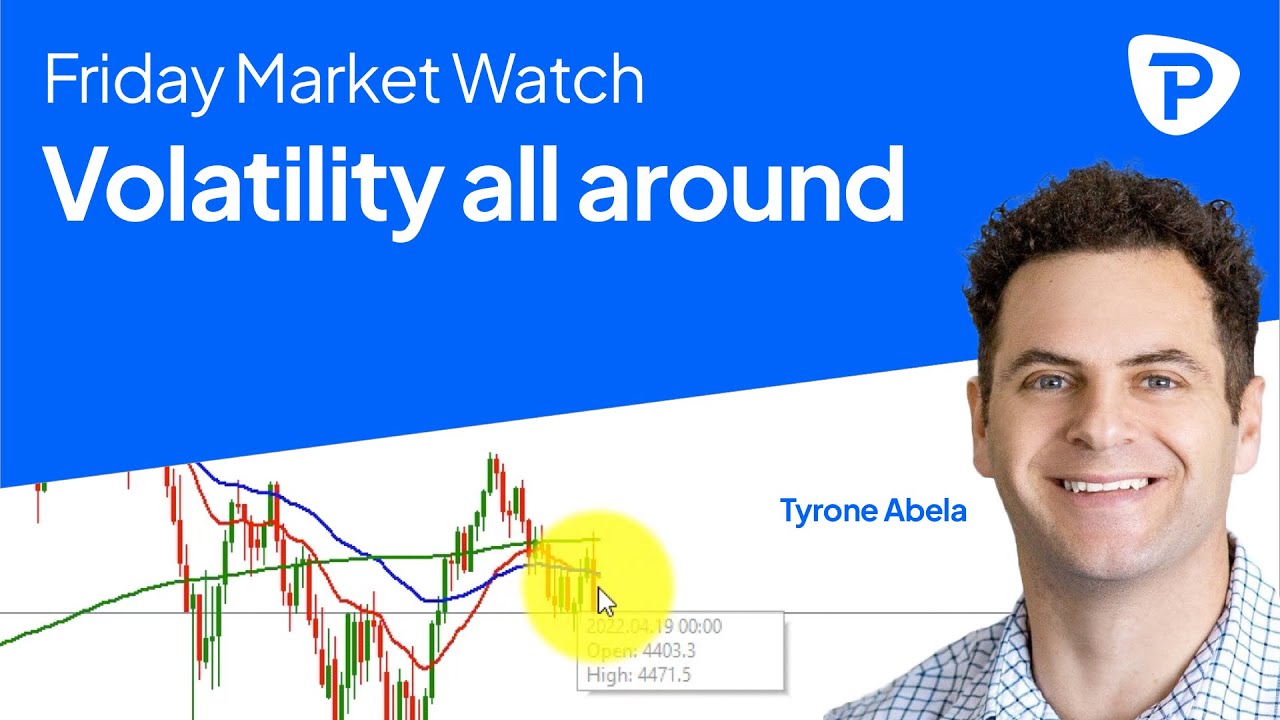

Bitcoin recently experienced turbulent price swings as it neared the $27,000 threshold following remarks made by Jerome Powell, Chair of the United States Federal Reserve. Powell's comments regarding potential changes in monetary policy had a direct impact on the price action of Bitcoin (BTC). Traders closely scrutinized Powell's language, eagerly seeking clues about potential shifts in interest rate hikes.

Powell's Speech and Market Expectations Speaking at the Thomas Laubach Research Conference in Washington, D.C., Powell's speech drew significant attention from market participants. Prior to his address, concerns had already emerged due to statements made by other Fed officials and the release of jobless data, leading to heightened expectations of continued interest rate hikes.

Powell acknowledged the impact of financial stability tools on the banking sector, noting that while they helped calm conditions, they also contributed to tighter credit conditions. He cautioned that these developments might hinder economic growth, hiring, and inflation. Powell emphasized the uncertainty surrounding the extent of interest rate hikes, highlighting the disparity between market expectations and the Fed's forecast, which likely reflected differing views on the pace of inflation reduction.

Bitcoin's Volatility and Market Sentiment Bitcoin, known for its sensitivity to interest rate expectations, responded with increased volatility to Powell's comments. Before his speech, an analysis of the Binance BTC/USD order book showed limited support above $26,000, while ask liquidity gradually accumulated around the spot price of $27,300.

Coinciding with Bitcoin's volatility, the U.S. dollar experienced a slight weakening. Typically inversely correlated with the cryptocurrency, the U.S. dollar index (DXY) declined by 0.4%, temporarily erasing the day's gains and reaching a level of 103. Furthermore, market sentiment swiftly shifted following Powell's appearance, with the probability of a pause in rate hikes in June rising from approximately 62% to 80% within the first half hour, according to CME Group's FedWatch Tool.

Conclusion

Bitcoin encountered significant price fluctuations as it approached $27,000 due to the impact of Jerome Powell's comments on monetary policy. Powell's remarks, combined with market expectations regarding interest rate hikes, played a crucial role in Bitcoin's volatility. Concurrently, the U.S. dollar exhibited a slight weakness, and market sentiment shifted towards the likelihood of a pause in rate hikes in June. Traders and investors will continue to closely monitor the Federal Reserve's actions and announcements as they navigate the ever-changing landscape of cryptocurrency markets.

What's Your Reaction?

Like

1

Like

1

Dislike

0

Dislike

0

Love

2

Love

2

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

1

Wow

1